FAQs on LIPA Court Judgment vs. Accepting LIPA’s Proposal

The Town Board has voted to accept the LIPA Settlement Proposal at 11:04 PM on September 3rd, 2020 during the special Town Board meeting scheduled to take place after the second public forum on the proposal, which began at approximately 6:00 PM. If you have questions on how the LIPA settlement proposal will affect you, please submit questions here.

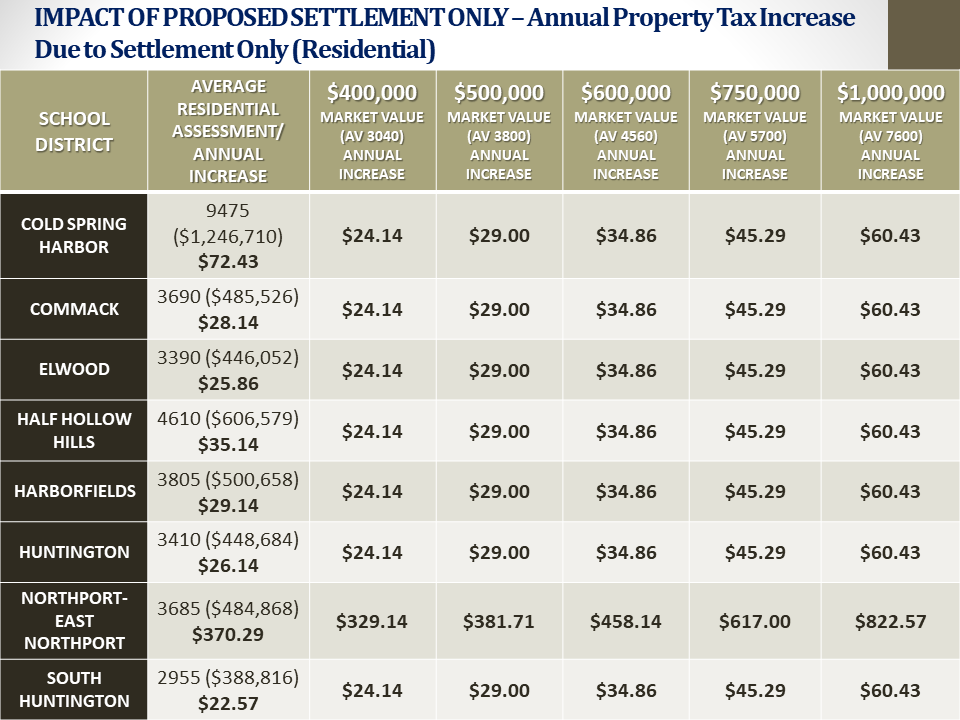

Residential Tax Impact of LIPA Settlement (click chart to view full slideshow)

Bolded questions have recently been added or updated:

LIPA TAX CERTIORARI TRIAL FAQs

LIPA SETTLEMENT PROPOSAL FAQs

OTHER LIPA LITIGATION FAQs

Why is this happening during a national public health and economic crisis?

While the Town would have preferred to delay this litigation and wait until after the COVID-19 crisis ends to resume litigation, LIPA rejected the Town’s April 2020 request to pause litigation.

The LIPA tax certiorari litigation has been in the courts for nearly 10 years. The first trial, on the 2014 assessment, took place in 2019 with testimony concluding in July 2019.

After hundreds of hours of negotiations between attorneys for the Town of Huntington, the Northport-East Northport School District, LIPA and National Grid, the Town received LIPA’s latest settlement proposal on July 2, 2020 with a deadline of August 11, 2020 to accept the offer.

After initially scheduling public forums on the LIPA proposal for August 10 and September 16 and scheduling a special meeting on September 29 to vote on the offer, LIPA called for a court judgment while stating that their August 11 deadline was open but firm. After holding the first public forum on August 10, the Town Board rescheduled the second public forum and special meeting for September 3 after receiving assurances from LIPA that the offer would remain on the table through September 3.

back to top

Why do taxpayers in the Northport-East Northport School District face a greater financial impact?

Residents of the Northport-East Northport School District face a greater financial impact because nearly two-thirds (2/3) of LIPA’s taxes are comprised of school district taxes. So, if LIPA’s portion of school taxes decreases, this would result in a commensurate increase for property taxpayers within the same school district.

back to top

LIPA TAX CERTIORARI TRIAL FAQs

What is the scope of the current tax certiorari trial?

The parties are trying the final assessment on the Northport Power Plant property for the 2014 assessment.

back to top

What happens if the court rules in favor of the Town of Huntington for the 2014 assessment?

A ruling in favor of the Town of Huntington on the Northport Power Plant tax certiorari proceedings for the 2014 assessment would resolve the litigation for the 2015 Tax Year; it would not shield us against the other existing tax challenges. LIPA/National Grid would still be able to proceed in their existing tax certiorari lawsuits filed from 2010-2013 and 2015-2019. The Town of Huntington has relied on the presumption of validity of the assessment and raised procedural and methodical arguments at the trial of the 2014 assessment; at subsequent trials, LIPA can adjust its case accordingly.

back to top

What happens if the court rules in favor of LIPA for the 2014 assessment?

If LIPA wins the 2014 trial, it could be entitled to refund and liability totaling $70.7M. LIPA would likely also argue that the court judgment for the 2014 assessment is precedential for the remaining trial years as there were no significant improvements to the Northport Power Plant over this period of time.

back to top

What happens if the court rules against the Town of Huntington in all pending cases?

If LIPA wins all of the tax certiorari cases on the Northport Power Plant property in court, this would result in an immediate property tax increase across the Town of Huntington and a nearly $825 million refund to LIPA, which every residential and commercial property owner in the Town would be liable to pay – not just Northport-East Northport School District property owners.

back to top

Who would be responsible for the refund payments owed to LIPA from a court judgment against the Town?

If the court rules against the Town of Huntington, all Town of Huntington property owners would be responsible for any refunds owed to LIPA.

These refunds, or "chargebacks," are a routine matter; every year Suffolk County bills Town residents for property tax refunds, initiated by successful property tax challenges, that the county initially laid out; property owners can find these chargebacks listed on their tax bill under "NYS Real Property Tax Law."

back to top

Why are taxpayers on the hook for a nearly $825 million judgment if the court rules against the Town of Huntington?

The refund owed to LIPA if the court rules against the Town consists of alleged yearly overassessments (every year for which LIPA has filed a tax certiorari lawsuit from 2010-2019) as well as interest.

back to top

Why would refund liability be distributed across all school districts in the Town when residents of the Northport-East Northport School District have benefitted from taxes paid on the Northport Power Plant the most?

Refund liability is governed by the Suffolk County Tax Act, not the Town of Huntington. If the court rules against the Town, the judgment would be made against the Town of Huntington, not just the Northport-East Northport School District; while a portion of the taxes on the Northport Power Plant property funds the Northport-East Northport School District due to its location within the school district, the remaining property taxes paid on the plant fund Suffolk County, the Town of Huntington and other taxing districts.

back to top

How long would Town of Huntington property owners have to make refund payments owed to LIPA if the court rules against the Town?

Due to the unique nature of this case, we can only speculate; history tells us that a refund for a judgment would likely be paid off as a lump sum in one payment through the property tax bill.

back to top

If property owners are unable to afford these potential refund payments owed to LIPA, will the Town put a lien on properties or implement collections procedures?

No. The Town does not utilize any collection procedures. The Town does not put liens on property for failure to pay property taxes; only the County of Suffolk has the authority to do that.

back to top

How would a court ruling against the Town affect me? What would I owe as a property owner in the Town of Huntington?

The potential tax increase and refund payment each property owner would owe if the court rules against the Town would be based on your property’s assessment and details of the court’s judgment regarding the assessment of the Northport Power Plant property; the actual result of a court ruling against the Town cannot be known unless and until the court makes a decision.

back to top

Would former Town of Huntington residents who owned property between 2010 and 2019, but have since sold, be responsible for refund payments to LIPA if the court rules against the Town?

No. If the court rules against the Town, the property owner at the time of a judgment would be responsible, not the prior owner. Similarly, if a homeowner sells before a potential ruling, the new homeowner would be liable for a court-ordered judgment owed to LIPA. The same would also apply for commercial property owners.

back to top

If the court rules against the Town and in the event of an unsuccessful appeal, could the Town float a bond issue rather than placing the burden on Town of Huntington taxpayers?

The Town could certainly appeal an adverse judgment, during which time interest would continue to accrue, but the Town would and could not bond any judgment; technically, Suffolk County is responsible for paying the judgment, not the Town. A bond of this kind would impair our financial position and probably cause the Town to exceed the State-imposed 2% Tax Cap every year. Additionally, the Town’s taxpayers would have to pay interest to borrow the money to pay the judgment.

back to top

LIPA SETTLEMENT PROPOSAL FAQs

What are the terms of LIPA’s latest settlement proposal?

TERMS OF LIPA PROPOSAL (7/2/2020)

In order to take effect, the LIPA Proposal (7-2-2020) must be accepted by both the Northport-East Northport School District (by July 23, 2020) and the Town of Huntington (by September 3, 2020). If accepted, LIPA would forego the collection of a potential refund of approximately $825 million, to be paid as a one-time payment by each property owner in the Town of Huntington, in the event of a Supreme Court ruling against the Town of Huntington.

LIPA Proposal Public Forum:

back to top

What happens if the Town of Huntington accepts LIPA’s latest settlement proposal?

If the Town of Huntington accepts the terms of LIPA's latest settlement proposal, LIPA has agreed to abandon all of their existing property tax challenges from Tax Years 2010 through 2019, so no refund would be owed to LIPA, and property taxes would gradually increase over the course of the 7-year term of the accepted proposal based on a property's assessment and school district.

If the Town accepts the offer, the Town of Huntington and our taxpayers would also be protected from any tax challenges on the Northport Power Plant property during the 7-year timeline of the accepted offer, which coincides with the expiration of LIPA and National Grid’s current Power Supply Agreement in 2027; the right to challenge the assessment of the Northport Power Plant property would be eliminated for the 7 years if the proposal is accepted and the Town complies with the terms of the settlement agreement.

If the Town accepts the offer and if LIPA and National Grid renew their Power Supply Agreement after 7 years, even only in part, the Town and our taxpayers would also be protected against any tax challenges on the Northport Power Plant for 5 additional years; the right to challenge the assessment of the Northport Power Plant property would be eliminated for the additional 5 years if the proposal is accepted and LIPA and National Grid renew their Power Supply Agreement for any time past 2027, in whole or in part.

In the Town accepts the offer, LIPA has also agreed to pay an additional $14.5 million directly to the Northport-East Northport School District, in which the Northport Power Plant property is located; this payment offer is unprecedented compared to any offer any municipality has ever negotiated with LIPA, including previous offers negotiated with the Town of Huntington, and it would help offset tax increases to district residents and/or preserve educational programs while giving the school district time to plan for their future.

back to top

Who negotiated the terms of LIPA’s latest settlement proposal?

Attorneys for the Town of Huntington, the Northport-East Northport School District, LIPA and National Grid negotiated the terms of LIPA’s latest proposal.

back to top

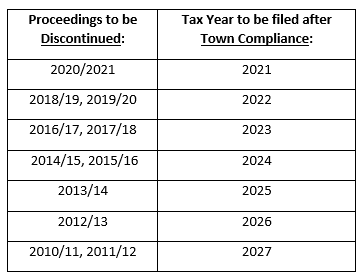

Since 2010, LIPA and National Grid have filed tax certiorari petitions every year, including the 2019 assessment. Would actions on all years from 2010 through 2019 be dropped if the proposed settlement offer is accepted?

Yes. If the Town votes to accept the terms of LIPA’s proposal, LIPA would immediately execute stipulations of discontinuance and release from escrow such stipulations upon compliance by the Town in accordance with the following schedule:

back to top

If the Town accepts LIPA’s proposal, could the annual tax increase to homeowners and commercial property owners continue beyond year 7? If so, at what rate and for how long?

If the Town accepts LIPA's proposal, after Year 7, the annual increase to residential and commercial property taxpayers would drop substantially as we would be holding the taxes on the Northport Power Plant property flat at $46M for an additional 5 years if LIPA and National Grid renew their Power Supply Agreement in whole or in part. During that time, we anticipate that we would need to reduce the Assessed Value (AV) on the NPP property about .75% each year to keep the tax payment flat; as compared to approximately 8.75% during Years 1-7.

In the LIPA Forum Presentation slideshow, on the last slide labeled “Comparison of Various Proposals,” under Proposal, the second row is labeled “NYS” – what does that stand for?

“NYS” stands for the settlement proposal made by LIPA in 2013 that was endorsed by the Governor, Speaker of the Assembly, and Senate Majority Leader. This settlement proposal called for tax reductions of 10 percent per year for ten years.

back to top

Why isn't the public voting on the LIPA settlement proposal?

The Town Board is elected by the whole of Town of Huntington resident voters to make just this kind of decision. There are certain decisions that are, by statute, subject to either a permissive or mandatory referendum; the settlement of a lawsuit is not one of those items. The Town Board votes to settle lawsuits of all natures as routine matters of business.

There is wisdom in the legislative decision to not subject a lawsuit to a referendum; discussion of litigation is a matter that is exempt from the Open Meetings Law because it involves confidential communications between attorneys and their clients -- confidential communications that may contain information, which, if released to the public, could either help or hurt a client's case in a court trial or settlement negotiations, for example, thus a client -- in this case, the Town Board -- has access to additional information regarding a lawsuit that the public does not.

back to top

Why does the Town Board resolution considering the settlement proposal empower the Town Attorney to execute a settlement agreement with LIPA? Shouldn't the Town Board and the community have an opportunity to review the agreement prior to officially signing the agreement?

This resolution is consistent with the practice of the Town Board to authorize the subsequent execution of a document; for example, the Town Board routinely authorizes the Supervisor to execute contracts and the Town Attorney to execute retainers and settlement documents.

The Town Board resolution authorizes the execution of a formal settlement agreement in accordance with the terms of the July 2 Term Sheet. That term sheet is attached to the resolution and is seven pages, single-spaced, and

has been shared with the public since July 10. The formal settlement agreement is largely a formality of taking the term sheet and putting it into a formal legal document. The key terms are set forth in the Term Sheet. It is the Town Board, not the Town Attorney, that has the power to approve a settlement. The Town Attorney simply signs the formal settlement agreement.

back to top

OTHER LIPA LITIGATION FAQs

How is this case even in court? Wasn't there a signed contract that stated LIPA would not refute the taxes on the Northport Power Plant property?

There was never a signed agreement between the Town of Huntington and LILCO, LIPA or National Grid regarding the property taxes at the Northport Power Plant property. Rather, there was a Power Supply Agreement between LIPA and LILCO in which LIPA agreed to pay the taxes on the property. It is the Town's contention that the Power Supply Agreement executed between LIPA and LILCO included language protecting the Town of Huntington from tax challenges; this language was removed in a subsequent Power Supply Agreement between LIPA and National Grid. The Town filed a case against LIPA and National Grid seeking to enforce the language in the LIPA-LILCO Power Supply Agreement, as the Town’s argument is that the Town is a third-party beneficiary of that agreement; unfortunately, the Court ruled that the language does not bar property tax challenges by LIPA; the Town has appealed that ruling and is awaiting a judgment on the appeal.

back to top

Doesn’t New York State Law protect taxpayers from a court ruling against the Town?

No. Legislation protecting the Town and our taxpayers against tax challenges by State agencies or utilities has not passed both houses of the New York State Legislature, and if it did, it would also have to be signed by the Governor before it could be enacted. After repeated calls from the Town of Huntington to Suffolk County and State Officials, including the Governor, to intercede in this matter, the Governor – the only official who can singlehandedly end this litigation – has chosen not to intervene.

back to top

Why hasn't the Town submitted its own independent appraisal of the Northport Power Plant property to the court to refute LIPA's submitted appraisal?

Property assessments are considered presumptively valid and the burden is on the property owner to demonstrate by substantial evidence that the assessment is in error. The Town did not submit an independent appraisal in this case; instead the Town made the strategic decision to rely on the statutory presumption of correctness. Additionally, the Town submitted an expert report from an economist to highlight issues LIPA ignored in their report, including items that should have increased LIPA’s valuation of the power plant.

Unfortunately, the Town cannot expand further on this answer as it involves attorney-client privilege and it would reveal internal strategic litigation strategy protected by that privilege; residents should rest assured the Town has extensively litigated this case and left no stone unturned in its defense.

back to top

Has the value of the Iroquois Pipeline been considered in the assessment of the Northport Power Plant property, trial litigation or settlement negotiations?

The Iroquois Gas Transmission System is separately assessed and billed apart from the Northport Power Plant property, and thus, it has no bearing on this case. Further, every gas power-fired power plant must by definition have access to a gas pipeline. This is in no way a unique feature constituting an economic enhancement to the Northport Power Plant facility or property.

back to top

What would it take for the Town to reconsider the use of eminent domain?

Eminent Domain would be a policy decision made by the Town Board. The Town Attorney’s office prepared a report for the Town Board on eminent domain, which the Town Board voted to release to the public. The hurdles to eminent domain are described in that report as follows:

- Mandatory referendum; voter approval pursuant to General Municipal Law Section 360(5)

- The Town must establish that there is a public purpose for the acquisition

- LIPA could decline any request to assign to the Power Supply Agreement to the Town of Huntington

- Unclear whether a municipality (in this case, the Town of Huntington) can acquire a power plant where most of the capacity produced is surplus and not a service to Town of Huntington residents

- Unlikely the Town of Huntington can condemn facilities in the service area of LIPA based on case law and opinions by the New York State Attorney General

- Acquisition by the Town of Huntington would make the Northport Power Plant property tax-exempt and there appears to be no legal mechanism to make the School District whole from the loss of tens of millions of dollars of tax payments

back to top

What is the status of other litigations concerning legacy power plants on Long Island?

The Town of Brookhaven settled its lawsuit over the Port Jefferson Power Plant in December 2018. The County of Nassau executed a Stipulation and Order with LIPA in December 2019 concerning the Glenwood Power Plant and E.F. Barrett Generation Station; the settlement is still pending as it requires the approval of a PILOT agreement by the Nassau County Legislature.

back to top

Did the Town of Huntington hire a LIPA lobbyist?

No. Mercury Public Affairs, LLC, did not work for LIPA; Mercury worked for National Grid briefly 13 years ago. They currently represent PSEG, which is not a party to this case.

back to top

What work is Mercury Public Affairs doing in connection with the LIPA case?

Mercury Public Affairs, LLC, is a New York-based firm with the necessary expertise and experience in public outreach, also knowledgeable about the Northport Power Plant and the pending litigations. Mercury was hired to assist the Town in educating taxpayers about the terms of the LIPA settlement proposal, the impact of a settlement on property taxes, and the potential consequences of an adverse court judgment.

back to top